Free Masterclass | The 10x Buyer: How to Make Your Procurement Team 10x More Productive with 55 AI Agents

Register now

- SolutionsOn Demand

- ExploreLearn

- Customers

- For Suppliers

The news is currently full of reports on developments in US tariffs, as the entire global economy is affected by the new political course taken by the US. Donald Trump has raised import tariffs on most EU goods to 15%, simultaneously imposing higher rates on almost 70 other countries (DER SPIEGEL). India has been hit particularly hard, as it now faces tariffs totaling 50% on its oil imports from Russia (FAZ), prompting New Delhi to immediately take economic and political countermeasures, including suspending planned arms purchases from the US (Merkur). Brazil is also affected by the 50% tariff and is working with partners such as the BRICS countries to coordinate a response (FAZ). Even close trading partners such as Switzerland now have to pay 39% (DW). The effects are already being felt in industry: Jaguar Land Rover's profits have fallen sharply as a result of the US tariffs (Handelsblatt). For purchasing departments, this means that profound changes are on the horizon. In this blog, we highlight the key challenges and show how companies can respond strategically now.

Donald Trump is using tariffs as a political tool to exert political pressure, reduce trade deficits, protect US industry, and strengthen national economic autonomy as part of his "America First" strategy. At the same time, he has introduced tariffs on key strategic industries such as chips and pharmaceutical products, in some cases up to 100%, increase negotiating pressure on trading partners.

In the short term, these measures will lead to higher costs and considerable uncertainty in global trade, as companies will have to realign their supply chains. Many German exporters are already shifting their focus more toward Asia.

In the medium term, his tariff policy could become even more restrictive: tax revenues from tariffs regularly reach hundreds of billions of dollars per year, which could encourage him to use these revenues to offset tax cuts or finance the budget.

In the long term, there is a high risk that an unstable system will become established: case-by-case decisions, reciprocal tariff threats, and legal challenges , for example against declarations of emergency, could further undermine trade planning.

Trump's punitive tariffs in 2025 are aimed specifically at strategic industries such as:

Germany, as a long-standing trading partner, is explicitly included. The general minimum import duty of 10% and industry-specific surcharges significantly increase costs, exacerbate competitive positions, and extend delivery times. According to forecasts, semiconductor imports will become up to 25% more expensive and electrical components around 20% more expensive.

Trump's punitive tariffs for 2025 reveal a critical vulnerability: a comprehensive Bitkom survey shows that 81% of German companies are dependent on digital imports from the US; 41% describe themselves as highly dependent. These include chips, sensors, hardware, and software. According to a DIHK survey, over 70% of export-oriented SMEs feel compelled to restructure their supply chains.

In order to mitigate the risks of rising tariffs, interrupted supply chains, and longer delivery times, purchasing departments must establish resilient procurement structures in the short term and anchor them in the long term. The aim is to reduce dependencies, avoid supply bottlenecks, and be able to react flexibly to market changes.

Important strategies at a glance:

Reshoring is becoming particularly important, especially for high-quality and technologically sensitive components. Relocating back to Germany or Europe reduces customs risks, shortens delivery times, and improves quality assurance, even if this entails higher unit costs.

An example: German companies are increasingly investing in production facilities within Europe or North America to circumvent trade barriers and respond more quickly to a fragmented international market.

Flexible supplier management is key. One approach is to use hybrid procurement models, combining just-in-case strategies for critical components with just-in-time approaches, to minimize costs and avoid disruptions. It is important to develop reliable supplier relationships, establish alternative sources of supply, and build robust networks. In view of possible declines in exports to the US of up to 25% over the next two years, additional operational measures such as optimized warehouse logistics, contract flexibility, and forward-looking price negotiations are essential.

A key lever for reducing dependence on US companies is the targeted use of modern procurement platforms with integrated supplier management. These systems make it possible to evaluate potential and existing suppliers worldwide according to clearly defined criteria such as production capacity, quality standards, delivery reliability, and regulatory compliance. Automated risk analyses, for example, allow dependencies on specific countries or markets to be identified at an early stage and alternative sources of supply to be identified.

In addition, integrated onboarding and qualification processes help to quickly and seamlessly integrate new partners from more geopolitically neutral regions into the existing supply chain. This enables companies to circumvent trade restrictions in a targeted manner, diversify their supplier base, and become more strategically resilient. This leads to not only greater security of supply, but also a clear competitive advantage in international markets.

Technology roadmap

The introduction of modern procurement tools should be structured and carried out in clearly defined stages in order to maximize benefits step by step.

A typical roadmap for introducing a new procurement platform:

The result is a scalable, future-proof procurement system that can be flexibly adapted to market and political changes.

In short:

Companies should now actively diversify their supplier base, use procurement platforms with integrated supplier management, and establish hybrid procurement models. The decisive factor is a combination of early risk analysis, the development of alternative sources of supply, and the rapid integration of new partners. Those who consistently implement these measures can significantly reduce their dependence on US markets, increase the resilience of their supply chain by up to 40%, and secure a sustainable competitive advantage.

Trump's new punitive tariffs in 2025 will not only increase costs but also regulatory complexity. Certificates of origin, customs tariffs, and export restrictions are changing on a weekly basis in some cases, making it particularly difficult for export-oriented German companies to comply with regulations. Companies that rely on manual processes risk costly delays, contract breaches, and penalties.

The use of specialized procurement and compliance software is evolving from an optional tool to an operational necessity. Such systems automatically monitor changes in customs tariffs, calculate the total landed cost including all duties, and simulate procurement scenarios from different countries. This allows alternative suppliers, e.g., in the EU, Eastern Europe, or Asia, to be transparently compared in terms of costs, delivery times, and quality risks.

Competitive advantage:

Companies with digitized compliance workflows respond up to 40% faster to regulatory changes and avoid unnecessary customs costs. The investment often pays for itself with the first compliance violation prevented or the optimization of a critical procurement decision.

In addition to operational measures, companies should also actively represent their interests at the political level. Cooperation with chambers of commerce, industry associations, and European institutions offers the opportunity to influence future trade agreements and customs regulations. Targeted lobbying can address issues relevant to companies, such as

can be brought into political decision-making processes at an early stage.

Companies that incorporate this strategic level not only gain an information advantage, but also strengthen their negotiating position in international competition.

The implementation of strategic measures such as supplier diversification, nearshoring, or the use of modern procurement platforms involves initial investments, but these can quickly pay for themselves:

Conclusion: Companies that consistently implement these measures typically achieve a total return of 150–250% within three years, while significantly increasing their resilience and competitiveness.

Geopolitical tensions and trade conflicts are significantly increasing the volatility of the euro-dollar exchange rate, which means planning uncertainty and calculatory risks for purchasing companies. According to the Bank for International Settlements (BIS), financial markets reacted with severe turbulence to the unpredictable US tariff announcements, indicating how quickly exchange rates can be influenced by foreign policy shocks.

In addition, ECB President Christine Lagarde warns that trade and defense shocks could intensify inflationary dynamics in the eurozone and lead to persistently higher prices. These developments make investment and price calculations difficult over longer periods of time.

Purchasing teams must therefore take active countermeasures, e.g. through:

The combination of exchange rate risks, inflation, and trade uncertainties is leading to acute margin pressure. Strategically, the focus must be on risk diversification, while operationally, flexible contract mechanisms and active currency management are required.

Over the next three to five years, the procurement environment will continue to undergo fundamental changes. Generative AI will play a central role not only in supplier search, but also increasingly in contract analysis, market forecasting, and scenario planning. Regional trading blocs, such as those between the EU, ASEAN, and the BRICS countries, will gain in importance and realign trade flows. At the same time, we can expect to see an accelerated shift of critical industries to geopolitically stable regions to minimize dependencies. Companies that adapt to these trends early on will be able to increase their resilience and position themselves as pioneers in global competition.

Trump's tariffs are a wake-up call for purchasing organizations: Passive waiting is not an option. Those who diversify their supply chains, introduce digital procurement platforms, and actively manage currency and customs risks now will not only be able to cushion the current impact, but also emerge from the crisis stronger in the long term. The combination of strategic foresight, technological modernization, and decisive action will determine who remains successful in an increasingly fragmented global economy.

Donald Trump has raised import tariffs on most EU goods to 15%. In addition, around 70 other countries are affected by higher rates. Strategic industries such as semiconductors, mechanical engineering, the automotive industry, and high-tech components are particularly hard hit. Individual tariffs, e.g., on chips or pharmaceuticals, can be as high as 100%.

The measures will lead to higher import costs (e.g., +25% for semiconductors, +20% for electrical components), longer delivery times, and increasing uncertainty in trade planning. Over 70% of export-oriented SMEs feel compelled to restructure their supply chains.

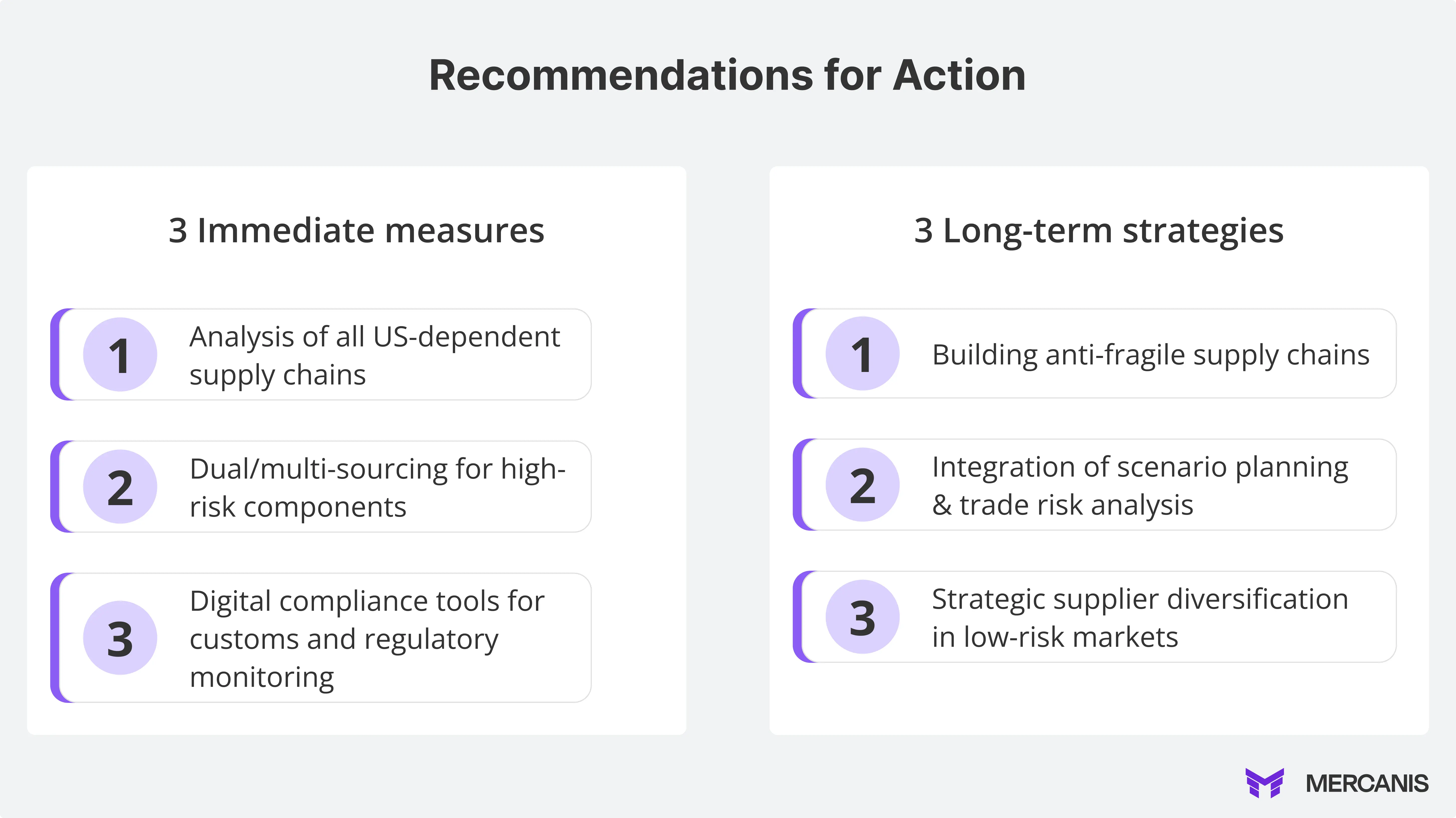

Three steps are crucial in the short term:

In the long term, it is advisable to establish highly resilient supply chains, integrate scenario planning and trade risk analyses, and strategically diversify suppliers in low-risk markets.

Nearshoring reduces transport times, costs, and customs risks by relocating procurement or production to geographically close countries. Reshoring brings production processes back to Germany or the EU, which improves supply security and quality control – despite higher unit costs.

Modern platforms enable:

Procurement/compliance platforms: $10,000–$150,000 per year, amortization in 9–18 months

Nearshoring: 3–5% of purchasing volume, ROI in 2–3 years

Dual/multi-sourcing: +1–3% short-term additional costs, but up to 60% risk reduction in the event of failures

Companies often achieve a total return of 150–250% in three years.

The USD/EUR exchange rate reacts strongly to geopolitical tensions and tariff policies. Rising inflation rates in the eurozone are increasing cost pressure. Purchasing departments should use currency hedging, dynamic price clauses, and commodity price monitoring.

Use of generative AI in supplier search, contract analysis, and scenario planning

Growing importance of regional trade blocs (e.g., EU–ASEAN, BRICS)

Relocation of critical industries to geopolitically stable regions

Passive waiting is not an option. Those who invest now in diversification, digital tools, and risk management will be able to cushion the current impact and emerge from the crisis stronger in the long term.

Fabian Heinrich is the CEO and co-founder of Mercanis. Previously he co-founded and grew the procurement company Scoutbee to become a global market leader in scouting with offices in Europe and the USA and serving clients like Siemens, Audi, Unilever. With a Bachelor's degree and a Master's in Accounting and Finance from the University of St. Gallen, his career spans roles at Deloitte and Rocket Internet SE.